The Rexpro Enterprises IPO is set to open on January 22, 2025, and will close on January 24, 2025. This is a Fixed Price Issue, with the company aiming to raise around ₹53.65 crores through the IPO. The offering comprises a fresh issue of ₹47.13 crores and an offer for sale of up to 4,50,000 equity shares with a face value of ₹10 each.

The price band for the Rexpro Enterprises IPO is ₹145 per share, and the retail quota stands at 50%, while QIB has a 0% allocation, and HNI will have 50% of the offering. The IPO is expected to list on NSE on January 29, 2025, with the allotment date scheduled for January 27, 2025.

Financial Highlights:

- Revenue for the company in 2024 stood at ₹83.01 crores, compared to ₹62.89 crores in 2023.

- Profit in 2024 reached ₹4.53 crores, up from ₹0.64 crores in 2023.

Rexpro Enterprises IPO Date & Price Band Details

| Category | Details |

|---|---|

| IPO Open Date: | January 22, 2025 |

| IPO Close Date: | January 24, 2025 |

| Face Value: | ₹10 Per Equity Share |

| IPO Price Band: | ₹145 Per Share |

| Issue Size: | Approx ₹53.65 Crores |

| Fresh Issue: | Approx ₹47.13 Crores |

| Offer for Sale: | Approx 4,50,000 Equity Shares |

| Issue Type: | Fixed Price Issue |

| IPO Listing: | NSE SME |

| Retail Quota: | Not more than 50% |

| NII Quota: | Not more than 50% |

| DRHP Draft Prospectus: | Click Here |

| RHP Draft Prospectus: | Click Here |

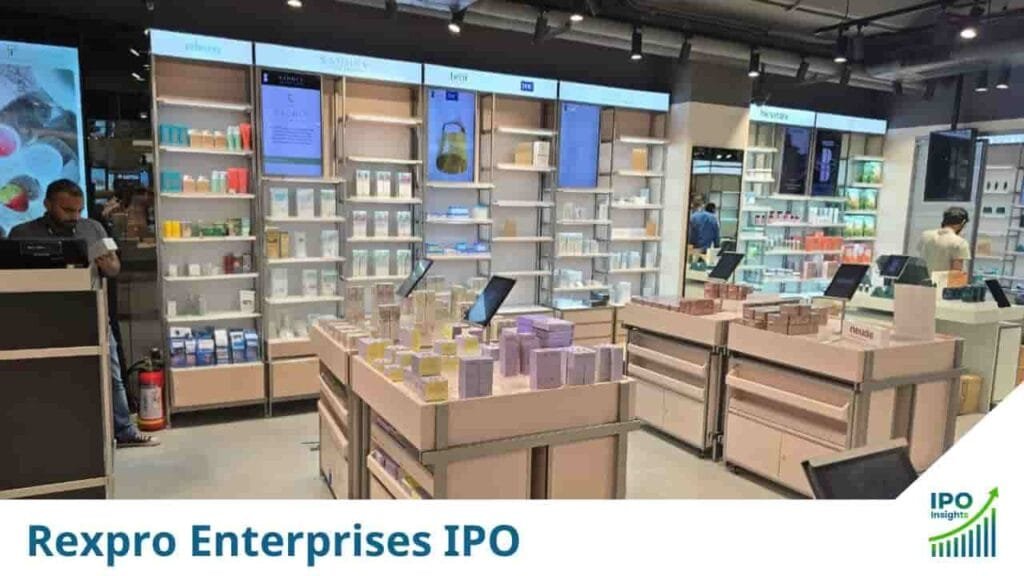

About Rexpro Enterprises Company Overview

Rexpro Enterprises is a leading furniture manufacturing company in India, specializing in:

- Retail Fixtures and Displays: Designing and manufacturing customized fixtures for various retail segments like fashion, lifestyle, electronics, and more.

- Commercial and Institutional Furniture: Providing furniture solutions for offices, hospitals, and government institutions.

- Home Furniture: Catering to the growing demand for stylish and functional home furniture.

Key Strengths

- Diversified Product Portfolio: Rexpro offers a wide range of products, reducing reliance on any single segment.

- Strong Client Base: The company boasts an impressive clientele, including major brands like Shoppers Stop, Samsung, and Hindustan Unilever.

- In-house Manufacturing Capabilities: This allows for greater control over quality, production timelines, and costs.

- Experienced Management Team: The company is led by a team with extensive experience in the furniture industry.

Potential Risks

- Competition: The furniture market is highly competitive, with both organized and unorganized players.

- Raw Material Costs: Fluctuations in raw material prices can impact profitability.

- Economic Slowdown: A slowdown in economic growth could impact consumer spending and demand for furniture.

- Execution Risks: Delays in project execution or supply chain disruptions can affect revenue and profitability.

Rexpro Enterprises IPO Market Lot

The Rexpro Enterprises IPO offers a minimum market lot of 1,000 shares, requiring an application amount of ₹1,45,000. This sizable investment opportunity is designed for investors looking to participate in this upcoming public offering. Make sure to review all IPO details, including price band, allotment dates, and listing information, to make an informed decision.

| Application | Lot Size | Shares | Amount |

|---|---|---|---|

| Retail Minimum | 1 | 1000 | ₹1,45,000 |

| Retail Maximum | 1 | 1000 | ₹1,45,000 |

| S-HNI Minimum | 2 | 2000 | ₹2,90,000 |

Rexpro Enterprises IPO Allotment & Listing Dates

The Rexpro Enterprises IPO is set to open for subscription on January 22, 2025, and will close on January 24, 2025. Investors eagerly awaiting the allotment can expect it to be finalized on January 27, 2025. The IPO listing on the stock exchange is scheduled for January 29, 2025. Stay tuned for further updates on this exciting opportunity!

| Type | Date |

|---|---|

| IPO Open Date: | January 22, 2025 |

| IPO Close Date: | January 24, 2025 |

| Basis of Allotment: | January 27, 2025 |

| Refunds: | January 28, 2025 |

| Credit to Demat Account: | January 28, 2025 |

| IPO Listing Date: | January 29, 2025 |

Promoters of Rexpro Enterprises IPO

The promoters of Rexpro Enterprises IPO include Minesh Anilbhai Chovatia, Premal Niranjan Shah, Ragesh Deepak Bhatia, and Ravishankar Sriramamurthi Malla. These key individuals bring extensive expertise and leadership to the company, playing a pivotal role in its strategic growth and future success.

Rexpro Enterprises IPO Company Financial Report

The company reported a revenue of ₹83.01 crores in 2024, showing significant growth compared to ₹62.89 crores in 2023. Additionally, the company’s profit surged to ₹4.53 crores in 2024, a remarkable increase from just ₹0.64 crores in 2023.

Amount ₹ in Crores

| Period Ended | Revenue | Expense | Profit After Tax | Assets |

|---|---|---|---|---|

| 2023 | ₹62.89 | ₹62.04 | ₹0.64 | ₹27.88 |

| 2024 | ₹83.01 | ₹76.08 | ₹4.53 | ₹39.96 |

| September 2024 | ₹49.56 | ₹44.04 | ₹3.86 | ₹50.54 |

Rexpro Enterprises IPO Valuation – FY2024

| KPI | Values |

|---|---|

| ROE: | 56.24% |

| ROCE: | 62.21% |

| EBITDA Margin: | 9.71% |

| PAT Margin: | 6.25% |

| Debt to equity ratio: | 0.65 |

| Earning Per Share (EPS): | ₹5.69 (Basic) |

| Price/Earning P/E Ratio: | 25.48 |

| Return on Net Worth (RoNW): | 56.24% |

| Net Asset Value (NAV): | ₹11.58 |

Rexpro Enterprises Peer Group Comparison

| Company | EPS | PE Ratio | RoNW % | NAV | Income |

|---|---|---|---|---|---|

| Naman InStore (India) Limited | 11.99 | 11.09 | 24.23% | – | 144.74 Cr. |

| Parin Enterprises Limited | 2.77 | 137.18 | 3.92% | – | 81.93 Cr. |

Objects of the Issue

- Investment in Equipment and Factory Renovation: Allocating funds for purchasing new machinery and upgrading existing factory infrastructure to boost operational efficiency and productivity.

- Working Capital Requirements: Strengthening the company’s financial foundation by enhancing working capital to support day-to-day operations and ensure smooth business activities.

- Inorganic Growth Strategies: Exploring and executing strategic acquisitions and partnerships to drive business expansion and market penetration.

- General Corporate Expenses: Covering miscellaneous corporate expenses necessary for the overall growth and sustainability of the organization.

Rexpro Enterprises IPO Review

- Canara Bank

- DRChoksey FinServ

- Emkay Global

- Hem Securities

- IDBI Capital

- Marwadi Shares

- Nirmal Bang

- SBICAP Securities

- Sharekhan

- SMC Global

- Sushil Finance

- Swastika Investmart

- Ventura Securities

- Geojit

- Reliance Securities

- Capital Market

- BP Wealth

- ICICIdirect

- Choice Broking

Rexpro Enterprises IPO Registrar

Cameo Corporate Services Limited

Phone: +91-44-28460390

Email: priya@cameoindia.com

Website: https://ipo.cameoindia.com/

Rexpro Enterprises IPO Lead Managers aka Merchant Bankers

- Horizon Management Private Limited

Company Address

Rexpro Enterprises Limited

Building No 2, WING A & B

Survey No -36, Hissa No 13, Waliv Village

Dhumal Nagar, Valiv, Thane, Vasai-401208,

Phone: +91 84848 32162

Email: cs@rexpro.co

Website: https://www.rexpro.co/

Rexpro Enterprises IPO FAQs

When will the Rexpro Enterprises IPO open and close for subscription?

The Rexpro Enterprises IPO will open on January 22, 2025, and close on January 24, 2025.

What type of issue is Rexpro Enterprises IPO?

It is a Fixed Price Issue, aiming to raise around ₹53.65 crores.

What is the price band and face value of Rexpro Enterprises IPO shares?

The price band is ₹145 per share, with a face value of ₹10 per equity share.

How much is the fresh issue and offer for sale (OFS) in Rexpro Enterprises IPO?

Fresh Issue: Approximately ₹47.13 crores

Offer for Sale: Up to 4,50,000 equity shares

What is the market lot and minimum investment for Rexpro Enterprises IPO?

The minimum market lot is 1,000 shares, and the minimum investment required is ₹1,45,000.

What is the retail investor quota for Rexpro Enterprises IPO?

The retail quota is 50%, NII quota is 50%, and there is no allocation for QIBs.

When will the allotment for Rexpro Enterprises IPO be finalized?

The allotment date is January 27, 2025.

When will Rexpro Enterprises IPO be listed?

The IPO is expected to list on NSE SME on January 29, 2025.

Who are the promoters of Rexpro Enterprises?

The promoters are Minesh Anilbhai Chovatia, Premal Niranjan Shah, Ragesh Deepak Bhatia, and Ravishankar Sriramamurthi Malla.

What are the financial highlights of Rexpro Enterprises?

Revenue grew from ₹62.89 crores in 2023 to ₹83.01 crores in 2024.

Profit surged from ₹0.64 crores in 2023 to ₹4.53 crores in 2024.

In September 2024, revenue stood at ₹49.56 crores, with a profit of ₹3.86 crores.

What are the key strengths of Rexpro Enterprises?

Diversified Product Portfolio: Reduces reliance on any single market segment.

Strong Client Base: Includes brands like Shoppers Stop, Samsung, and Hindustan Unilever.

In-house Manufacturing: Ensures better quality control and cost management.

Experienced Management Team: Comprising leaders with extensive industry experience.

What are the potential risks associated with Rexpro Enterprises?

Market Competition: Both organized and unorganized sectors.

Raw Material Costs: Price fluctuations can affect margins.

Economic Slowdown: Can impact consumer demand.

Execution Risks: Delays in projects or supply chain issues.

What are the key objectives of Rexpro Enterprises IPO?

Investment in Equipment and Factory Renovation

Funding Working Capital Requirements

Inorganic Growth Strategies

General Corporate Expenses

What is the ROE and ROCE for Rexpro Enterprises in FY2024?

ROE (Return on Equity): 56.24%

ROCE (Return on Capital Employed): 62.21%

How does Rexpro Enterprises compare with its peer companies?

Naman InStore (India) Limited: PE Ratio 11.09, EPS 11.99

Parin Enterprises Limited: PE Ratio 137.18, EPS 2.77

Disclaimer: This information is for general knowledge and informational purposes only and does not constitute financial, investment, or other professional advice.

Note: This information is based on the IPO schedule and details available as of January 9, 2025. Please refer to the official IPO documents for the most up-to-date information.